Exploring the realm of SaaS profit-sharing models that captivate the attention of global investors, this introduction sets the stage for a detailed analysis that promises to intrigue and inform. The discussion delves into the significance of profit-sharing structures in the SaaS industry and sheds light on the various models that hold appeal for investors worldwide.

Furthermore, it examines the factors that sway global investors towards these models and the intricacies involved in designing profit-sharing frameworks tailored for an international audience.

Understanding SaaS Profit-Sharing Models

Profit-sharing models in the SaaS industry play a crucial role in attracting global investors. These models define how profits are distributed among stakeholders, including shareholders, employees, and investors. By offering a fair and transparent profit-sharing structure, SaaS companies can entice investors looking for sustainable returns on their investment.

Importance of Profit-Sharing Models in Attracting Investment

Profit-sharing models serve as a financial incentive for investors to put their money into a SaaS company. It allows them to benefit directly from the company's success and growth. Furthermore, a well-designed profit-sharing model can align the interests of investors with those of the company, creating a mutually beneficial relationship that fosters long-term partnerships.

- Equity-Based Profit-Sharing: In this model, investors receive a share of ownership in the company in exchange for their investment. As the company grows and becomes more valuable, investors can realize significant returns through equity appreciation.

- Revenue-Sharing Agreements: This model involves sharing a percentage of the company's revenue with investors. It provides a predictable stream of income for investors, especially in the early stages of a SaaS company when profitability may be uncertain.

- Profit-Interest Certificates: These certificates entitle investors to a portion of the company's profits over a specified period. Investors receive a fixed return based on the company's profitability, offering a more secure investment option.

Factors Influencing Global Investors

In today's global market, there are several key factors that attract investors to SaaS profit-sharing models. These factors play a crucial role in influencing investors' decisions and shaping the success of profit-sharing ventures. Let's delve into the factors that drive global investors towards SaaS profit-sharing models.

Key Factors Attracting Global Investors

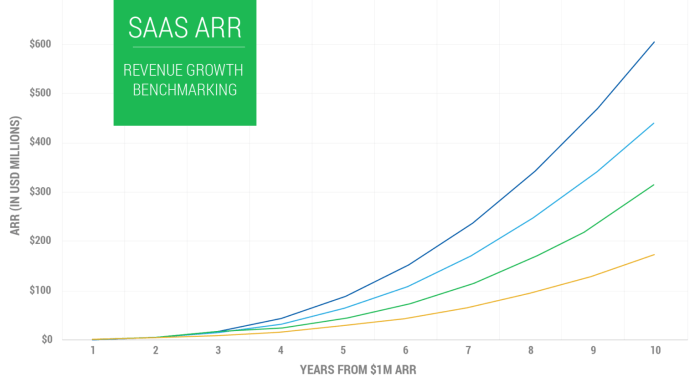

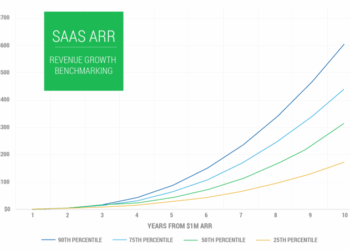

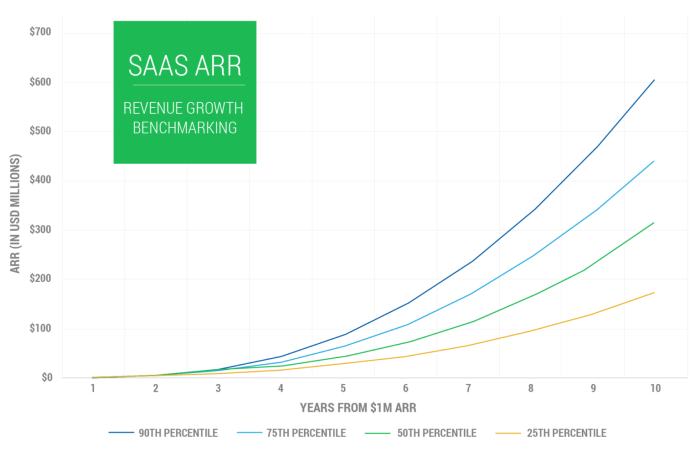

- Stable Revenue Streams: Global investors are drawn to SaaS profit-sharing models due to their predictable and recurring revenue streams. This stability provides a level of assurance and reduces the perceived risk associated with investments.

- Scalability and Growth Potential: SaaS businesses offer significant scalability and growth opportunities, making them an attractive investment option for global investors looking to maximize their returns.

- Cost-Efficiency: Profit-sharing models in the SaaS industry often require lower initial investment compared to traditional business models, making them more accessible to a broader range of investors.

Impact of Risk Factors on Investor Decisions

- Risk Mitigation Strategies: Global investors carefully evaluate the risk factors associated with SaaS profit-sharing models and look for robust risk mitigation strategies implemented by the businesses. Transparency in risk management practices can instill confidence in investors.

- Regulatory Compliance: Adherence to regulatory standards and data security measures is crucial for investors, as non-compliance can pose significant risks to investments in profit-sharing models. Companies that prioritize compliance are more likely to attract global investors.

- Market Volatility: Fluctuations in the market can impact investor decisions, especially in profit-sharing models. Investors prefer businesses that demonstrate resilience to market volatility and have strategies in place to navigate uncertainties.

Role of Geographical Diversification

Geographical diversification plays a vital role in appealing to global investors interested in SaaS profit-sharing models. By expanding operations across different regions, businesses can mitigate risks associated with economic downturns or geopolitical factors in a particular location. Additionally, geographical diversification enhances market reach and provides opportunities for growth, making the investment more attractive to global investors seeking expansion and stability.

Implementing Profit-Sharing Structures

Implementing profit-sharing structures can be a strategic way to attract global investors to your SaaS business. By offering a share of the profits, you can incentivize investors to support your growth and success. Let's explore successful profit-sharing structures, steps in designing tailored models, and challenges faced in implementation.

Examples of Successful Profit-Sharing Structures

- Revenue Sharing: Companies like Airbnb and Uber have implemented revenue-sharing models where investors receive a percentage of the profits generated from each transaction.

- Equity-Based Profit Sharing: Startups often offer equity to investors in exchange for funding, allowing them to share in the company's success as it grows.

- Performance-Based Profit Sharing: Some companies tie profit-sharing to specific performance metrics, ensuring that investors are rewarded based on the company's achievements.

Steps in Designing a Profit-Sharing Model for International Investors

- Understand Investor Preferences: Conduct market research to identify what types of profit-sharing structures appeal most to international investors.

- Legal Considerations: Work with legal advisors to ensure your profit-sharing model complies with international regulations and tax laws.

- Cultural Sensitivity: Take into account cultural differences when designing your profit-sharing model to ensure it resonates with a global audience.

Challenges and Considerations in Implementing Profit-Sharing Models Across Different Regions

- Regulatory Hurdles: Different countries have varying regulations around profit-sharing, making it crucial to navigate legal complexities when expanding internationally.

- Currency Fluctuations: Profit-sharing models may be impacted by currency exchange rates, requiring careful planning to mitigate financial risks.

- Communication Challenges: Cultural and language barriers can pose challenges in effectively communicating the benefits of a profit-sharing model to international investors.

Legal and Regulatory Considerations

Legal and regulatory considerations play a crucial role in profit-sharing models for SaaS companies looking to attract global investors. Ensuring compliance with international regulations is essential to maintain transparency and trust in profit-sharing agreements. Legal advisors are instrumental in structuring these models to provide clarity and security for investors.

Implications of Profit-Sharing Models

- Profit-sharing models may be subject to various legal implications, including tax considerations, intellectual property rights, and contract law.

- Companies must navigate different legal frameworks in various countries to ensure that profit-sharing agreements are valid and enforceable.

- Legal advisors help SaaS companies understand the legal risks associated with profit-sharing models and develop strategies to mitigate these risks.

Importance of Compliance with International Regulations

- Compliance with international regulations is crucial to avoid legal disputes and maintain investor confidence in profit-sharing structures.

- Companies must adhere to anti-corruption laws, data privacy regulations, and securities laws when implementing profit-sharing models.

- Legal advisors assist in ensuring that profit-sharing agreements comply with the laws of the jurisdictions involved to prevent regulatory issues.

Role of Legal Advisors

- Legal advisors help SaaS companies draft profit-sharing agreements that clearly Artikel the rights and obligations of both parties involved.

- They provide guidance on structuring profit-sharing models to align with international legal standards and best practices.

- Legal advisors also assist in resolving any legal disputes that may arise during the implementation of profit-sharing agreements, safeguarding the interests of both the company and investors.

Ultimate Conclusion

As we wrap up our exploration of SaaS profit-sharing models, it's evident that these innovative structures offer a compelling avenue for attracting global investors. By understanding the nuances of profit-sharing agreements and staying abreast of legal considerations, companies can pave the way for fruitful collaborations with investors on a global scale.

Question Bank

What are the key benefits of SaaS profit-sharing models for global investors?

Answer: SaaS profit-sharing models provide investors with a unique opportunity to earn returns based on the success of the software as a service company, aligning their interests with the company's growth.

How do geographical diversification impact global investors' interest in profit-sharing models?

Answer: Geographical diversification can help mitigate risk for investors by spreading their investments across different regions, enhancing the appeal of profit-sharing models.

What role do legal advisors play in structuring profit-sharing agreements?

Answer: Legal advisors are crucial in ensuring that profit-sharing models comply with international regulations and are designed to instill confidence in investors regarding legal implications.